Tax Income Limits 2025. Yet while there's no doubt we'll all be taxed, the rates can change rapidly. In 2025, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the.

Plus, there’s good news for savers: The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

In 2025, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, 2025 federal income tax rates. This guide is also available in welsh.

401k Annual Limit 2025 Reeva Celestyn, The deadline to file your 2025 tax return was monday, april 15, 2025. Roth ira contribution and income limits 2025.

2019 tax brackets california and federal, In 2025, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the. The tax brackets are the same in both the 2025 and 2025 tax years.

Medicare Blog Moorestown, Cranford NJ, This guide is also available in welsh. Roth ira contribution and income limits 2025.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, But, for roth iras, you can only contribute the maximum amount up to certain income limits. The new 2025 income tax brackets.

Calfresh Guidelines 2025, Nothing's as certain as death and taxes. But, for roth iras, you can only contribute the maximum amount up to certain income limits.

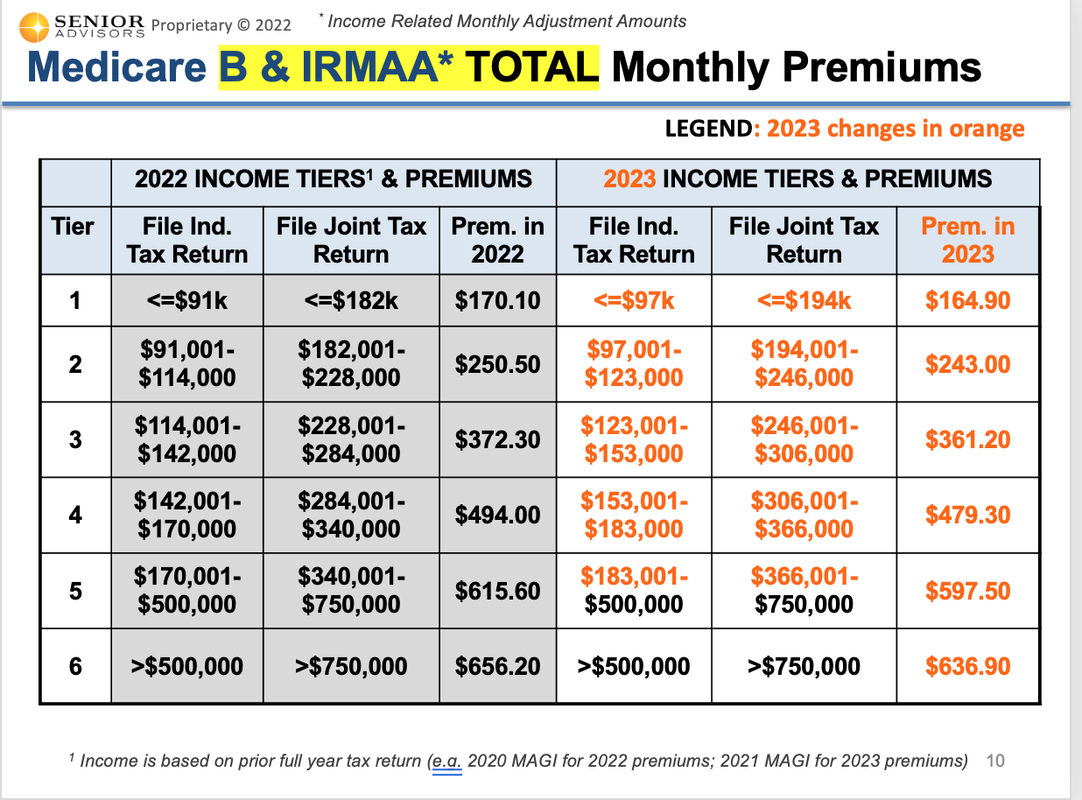

2017 Irmaa Chart, Your taxable income is your income after various deductions, credits, and exemptions have been. The irs has raised the maximum amount for households who claim the earned income tax credit (eitc) to $7,830 for the tax year 2025 for individuals who.

Tax Deductible Ira Limits 2025 Brooke Cassandre, The tax brackets are the same in both the 2025 and 2025 tax years. For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying.

limits San Benito, TX Official Website, Here are the tax brackets for tax years 2025 and 2025, and how you can figure out which tax bracket you fit into. In 2025, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the.

Fsa 2025 Contribution Limits 2025 Calendar, In 2025, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the. This guide is also available in welsh.