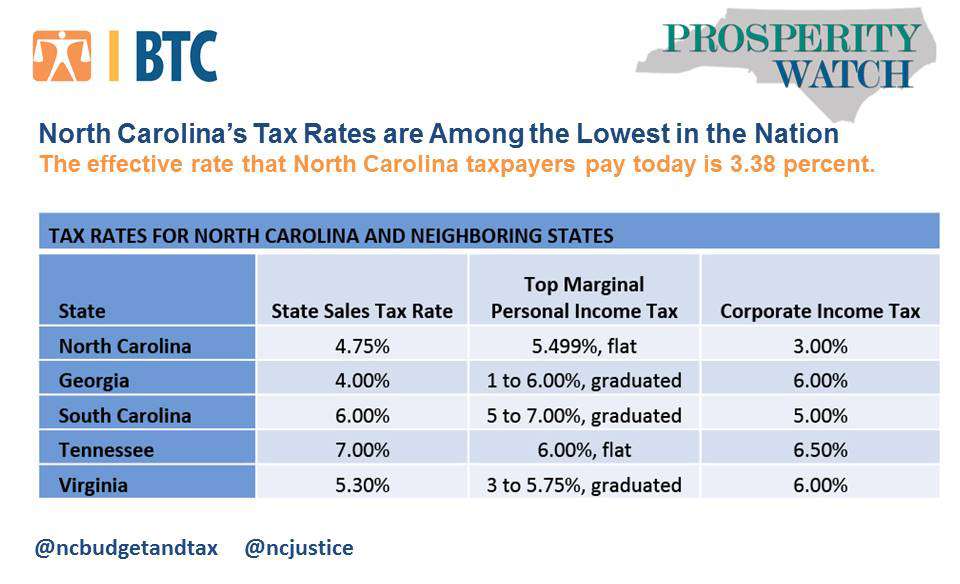

North Carolina Supplemental Tax Rate 2025. The 2025 tax rates and thresholds for both the north carolina state tax tables and federal tax tables are comprehensively integrated into the north carolina tax calculator for 2025. Effective for taxable years beginning on or after january 1, 2025, the personal income tax rate is gradually lowered from the current rate of 4.75% to 3.99% over three years.

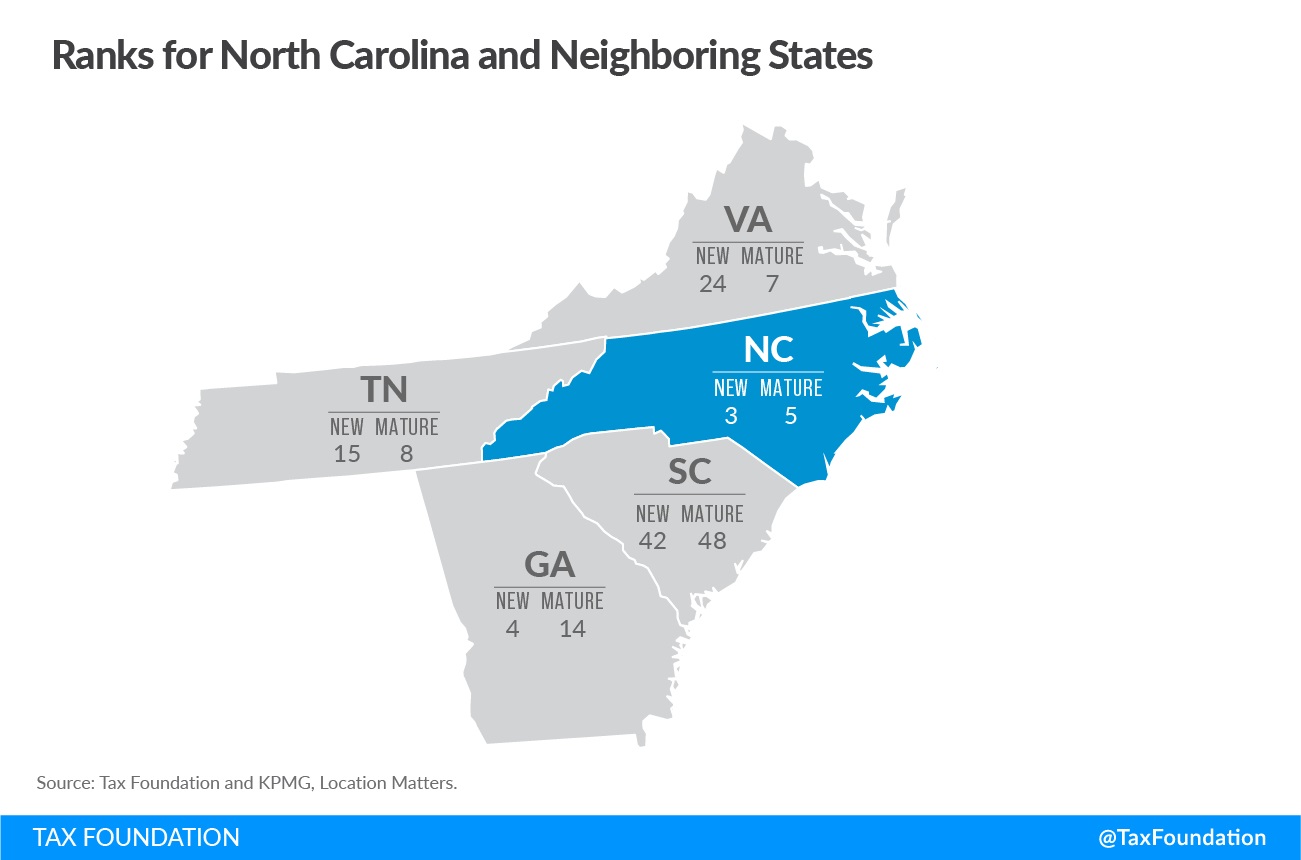

Effective january 1, 2025, the tax rate. If lawmakers phase down the rate to 2.49 percent by 2030, north carolina would be on track to have the lowest individual income tax rate on wage and salary income in the.

North carolina's 2025 income tax brackets and tax rates, plus a north carolina income tax calculator.

The north carolina personal income tax rate will be 4.99% in 2025, 4.75% in 2025, 4.6% in 2025, 4.5% in 2025 and 4.25% in 2026.

North Carolina’s Tax Rates are Among the Lowest in the Nation North, Effective january 1, 2025, the tax rate. The north carolina personal income tax rate will be 4.99% in 2025, 4.75% in 2025, 4.6% in 2025, 4.5% in 2025 and 4.25% in 2026.

North Carolina's Gasoline Tax Rate is Low by Historical St… Flickr, What to expect when filing taxes this year 259, enacted in september 2025, north carolina accelerated the reduction of its flat individual income tax rate.

Furniture Industry in North Carolina EDPNC, For taxable years beginning in 2025, the north carolina individual income tax rate is 4.25%. The north carolina tax calculator includes tax.

Tax Brackets 2025 North Carolina TAXP, The north carolina personal income tax rate will be 4.99% in 2025, 4.75% in 2025, 4.6% in 2025, 4.5% in 2025 and 4.25% in 2026. Effective january 1, 2025, the tax rate.

NC Ranks Among Most Competitive Tax Structures for Businesses, Get the latest information about tax season 2025. Some states tax bonuses, which are also called supplemental earnings.

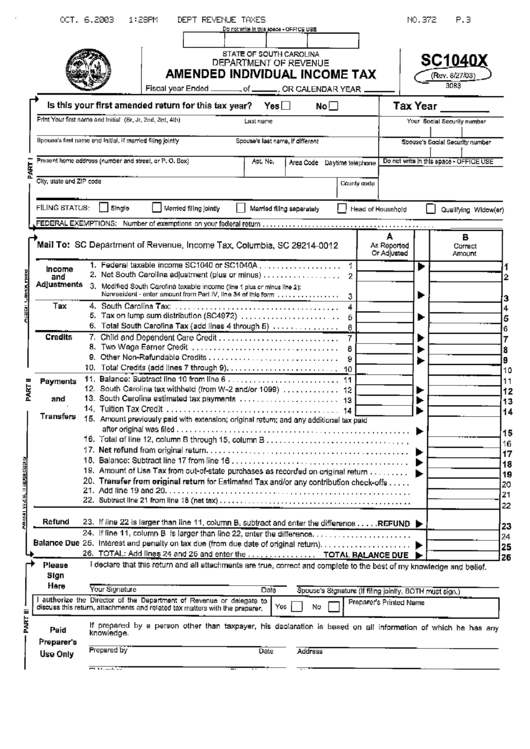

Supplemental Tax Rates By State When to Use Them & Examples, Under hb 259, enacted on october 3, 2025, without the signature of governor roy cooper, the personal income tax rate is gradually reduced starting in 2025 until it reaches 3.99% in 2026. Get the latest information about tax season 2025.

Tax rates for the 2025 year of assessment Just One Lap, The tax rate decreases to 4.5%, instead of 4.75%, the department said on the first page of north carolina’s 2025 withholding methods. The salary tax calculator for north carolina income tax calculations.

Wake North Carolina Supplemental Retirement Plan US Legal Forms, The north carolina tax calculator includes tax. Effective january 1, 2025, the tax rate.

Supplemental Educational Services in the State of North Carolina, Find north carolina’s supplemental rate in our payroll. For taxable years after 2025, the north carolina individual income tax rate is 3.99%.

Tax Deadline 2025 North Carolina Latest News Update, 2025 list of north carolina local sales tax rates. Get the latest information about tax season 2025.